IM532 3.0 Applied Time Series Forecasting

Dynamic regression models

Dr. Thiyanga Talagala

21 June 2020

Introduction

ARIMA models

ETS models

Dynamic regression models: How to include external variables

Regression model

yt=β0+β1x1,t+...+βkxk,t+ϵtyt=β0+β1x1,t+...+βkxk,t+ϵt

Allow the errors from a regression to contain autocorrelation.

yt=β0+β1x1,t+...+βkxk,t+ηtyt=β0+β1x1,t+...+βkxk,t+ηt (1−ϕ1B)(1−B)ηt=(1+θ1B)ϵt(1−ϕ1B)(1−B)ηt=(1+θ1B)ϵt

where ϵtϵt is a white noise series.

ηtηt follows an ARIMA(1,1,1)ARIMA(1,1,1)

Stationary variables vs Nonstationary Variables

If all of the variables in the model are stationary, then we only need to consider ARMA errors for the residuals

Regression model with ARIMA errors is equivalent to a regression model in differences with ARMA errors.

y′t=β0+β1x′1,t+...+βkx′k,t+η′ty′t=β0+β1x′1,t+...+βkx′k,t+η′t

(1−ϕ1B)η′t=(1+θ1B)ϵt(1−ϕ1B)η′t=(1+θ1B)ϵt

y′t=yt−yt−1y′t=yt−yt−1

x′t,i=xt,i−xt−1,ix′t,i=xt,i−xt−1,i

η′t=ηt−ηt−1η′t=ηt−ηt−1

Regression with ARIMA errors in R

To fit

y′t=β1x′t+η′t,y′t=β1x′t+η′t,

where η′t=ϕ1η′t−1+ϵtη′t=ϕ1η′t−1+ϵt is an AR(1)AR(1) error.

This is equivalent to

yt=β0+β1xt+ηtyt=β0+β1xt+ηt where ηtηt is an ARIMA(1,1,0)ARIMA(1,1,0) error.

Constant term disappears due to the differencing.

fit <- Arima(y, xreg=x, order=c(1,1,0))Using automated ARIMA algorithm

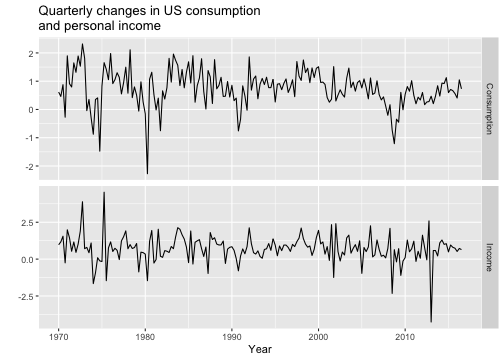

library(forecast)library(fpp2)head(uschange) Consumption Income Production Savings Unemployment1970 Q1 0.6159862 0.9722610 -2.4527003 4.8103115 0.91970 Q2 0.4603757 1.1690847 -0.5515251 7.2879923 0.51970 Q3 0.8767914 1.5532705 -0.3587079 7.2890131 0.51970 Q4 -0.2742451 -0.2552724 -2.1854549 0.9852296 0.71971 Q1 1.8973708 1.9871536 1.9097341 3.6577706 -0.11971 Q2 0.9119929 1.4473342 0.9015358 6.0513418 -0.1Using automated ARIMA algorithm

autoplot(uschange[,1:2], facets=TRUE) +xlab("Year") + ylab("") +ggtitle("Quarterly changes in US consumptionand personal income")

Using automated ARIMA algorithm

fit <- auto.arima(uschange[,"Consumption"],xreg=uschange[,"Income"])fitSeries: uschange[, "Consumption"] Regression with ARIMA(1,0,2) errors Coefficients: ar1 ma1 ma2 intercept xreg 0.6922 -0.5758 0.1984 0.5990 0.2028s.e. 0.1159 0.1301 0.0756 0.0884 0.0461sigma^2 estimated as 0.3219: log likelihood=-156.95AIC=325.91 AICc=326.37 BIC=345.29The fitted model is

ˆyt=0.599+0.203xt+ηt^yt=0.599+0.203xt+ηt

ηt=0.692ηt−1+ϵt−0.576ϵt−1+0.198ϵt−2ηt=0.692ηt−1+ϵt−0.576ϵt−1+0.198ϵt−2

ϵt∼NID(0,0.322)ϵt∼NID(0,0.322)

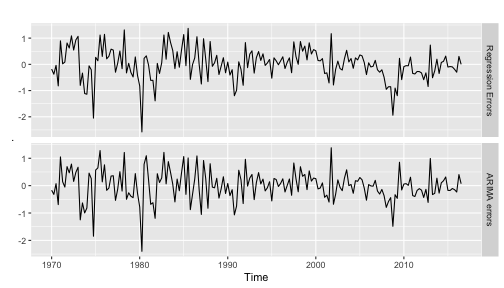

plot ηtηt and ϵtϵt

residuals function can be used to extract ηtηt and ϵtϵt.

library(magrittr)cbind("Regression Errors" = residuals(fit, type="regression"),"ARIMA errors" = residuals(fit, type="innovation")) %>%autoplot(facets=TRUE)

It is the ARIMA errors that should resemble a white noise series.

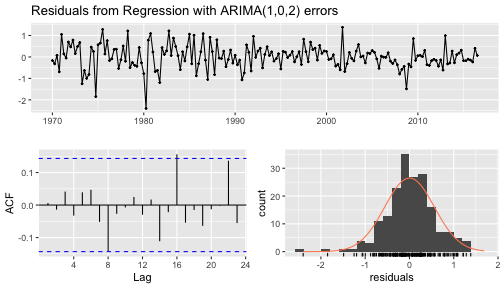

checkresiduals(fit)

Ljung-Box testdata: Residuals from Regression with ARIMA(1,0,2) errorsQ* = 5.8916, df = 3, p-value = 0.117Model df: 5. Total lags used: 8Calculate forecasts

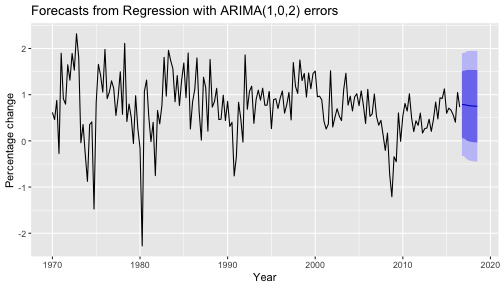

- We first need to forecast predictors

fcast <- forecast(fit, xreg=rep(mean(uschange[,2]),8))autoplot(fcast) + xlab("Year") + ylab("Percentage change")

Forecasting electricity demand

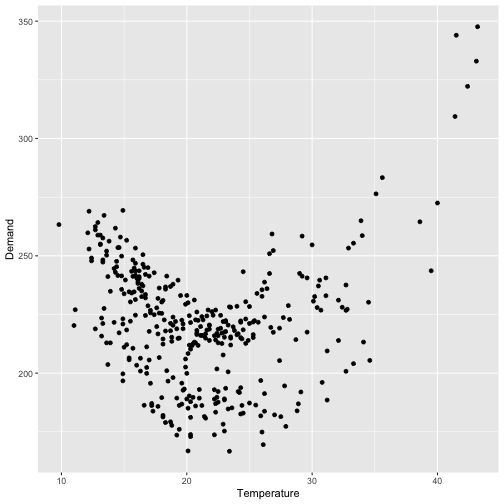

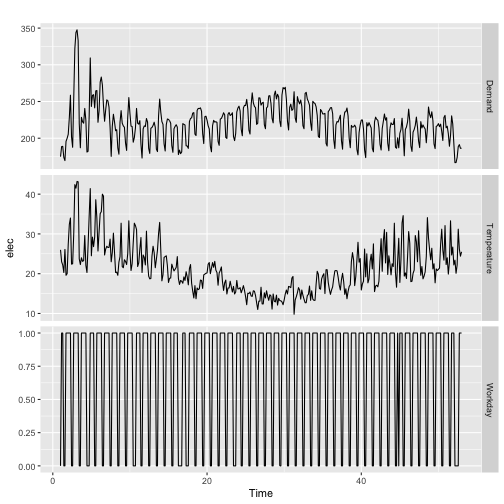

Model daily electricity demand as a function of temperature using quadratic regression with ARMA errors.

Forecasting electricity demand

Forecasting electricity demand

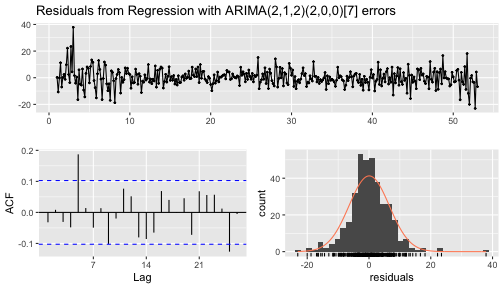

xreg <- cbind(MaxTemp = elecdaily[, "Temperature"],MaxTempSq = elecdaily[, "Temperature"]^2,Workday = elecdaily[, "WorkDay"])fit <- auto.arima(elecdaily[, "Demand"], xreg = xreg)fitSeries: elecdaily[, "Demand"] Regression with ARIMA(2,1,2)(2,0,0)[7] errors Coefficients: ar1 ar2 ma1 ma2 sar1 sar2 drift MaxTemp -0.0622 0.6731 -0.0234 -0.9301 0.2012 0.4021 -0.0191 -7.4996s.e. 0.0714 0.0667 0.0413 0.0390 0.0533 0.0567 0.1091 0.4409 MaxTempSq Workday 0.1789 30.5695s.e. 0.0084 1.2891sigma^2 estimated as 43.72: log likelihood=-1200.7AIC=2423.4 AICc=2424.15 BIC=2466.27Forecasting

forecast(fit, xreg = cbind(20, 20^2, 1)) # Forecast one day ahead Point Forecast Lo 80 Hi 80 Lo 95 Hi 9553.14286 185.4008 176.9271 193.8745 172.4414 198.3602Forecasting electricity demand (cont.)

checkresiduals(fit)

Ljung-Box testdata: Residuals from Regression with ARIMA(2,1,2)(2,0,0)[7] errorsQ* = 28.229, df = 4, p-value = 1.121e-05Model df: 10. Total lags used: 14Lagged predictors

yt=β0+γ0xt+γ1xt−1+...+γkxt−k+ηtyt=β0+γ0xt+γ1xt−1+...+γkxt−k+ηt

where ηtηt is an ARIMAARIMA process.

How to select kk ?

Use AICc along with the values of pp and qq for the ARIMA error.

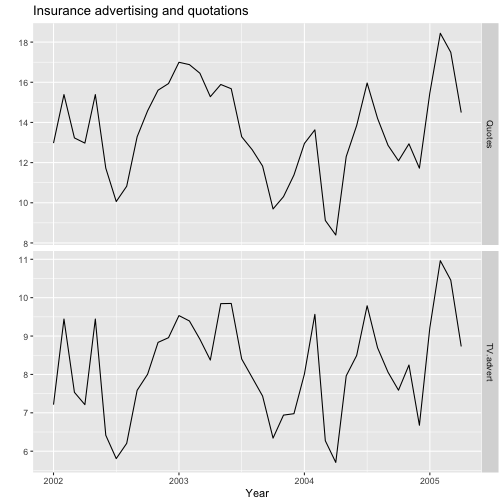

autoplot(insurance, facets=TRUE) +xlab("Year") + ylab("") +ggtitle("Insurance advertising and quotations")

Lagged predictors

Advert <- cbind(AdLag0 = insurance[,"TV.advert"],AdLag1 = stats::lag(insurance[,"TV.advert"],-1),AdLag2 = stats::lag(insurance[,"TV.advert"],-2),AdLag3 = stats::lag(insurance[,"TV.advert"],-3)) %>%head(NROW(insurance))head(Advert) AdLag0 AdLag1 AdLag2 AdLag3Jan 2002 7.212725 NA NA NAFeb 2002 9.443570 7.212725 NA NAMar 2002 7.534250 9.443570 7.212725 NAApr 2002 7.212725 7.534250 9.443570 7.212725May 2002 9.443570 7.212725 7.534250 9.443570Jun 2002 6.415215 9.443570 7.212725 7.534250Lagged predictors (cont.)

fit1 <- auto.arima(insurance[4:40,1], xreg=Advert[4:40,1],stationary=TRUE)fit1[["aicc"]][1] 68.49968fit2 <- auto.arima(insurance[4:40,1], xreg=Advert[4:40,1:2],stationary=TRUE)fit2[["aicc"]][1] 60.02357fit3 <- auto.arima(insurance[4:40,1], xreg=Advert[4:40,1:3],stationary=TRUE)fit3[["aicc"]][1] 62.83253fit4 <- auto.arima(insurance[4:40,1], xreg=Advert[4:40,1:4],stationary=TRUE)fit4[["aicc"]][1] 65.45747Lagged predictors (cont.)

Re-estimate the model

fit <- auto.arima(insurance[,1], xreg=Advert[,1:2],stationary=TRUE); fitSeries: insurance[, 1] Regression with ARIMA(3,0,0) errors Coefficients: ar1 ar2 ar3 intercept AdLag0 AdLag1 1.4117 -0.9317 0.3591 2.0393 1.2564 0.1625s.e. 0.1698 0.2545 0.1592 0.9931 0.0667 0.0591sigma^2 estimated as 0.2165: log likelihood=-23.89AIC=61.78 AICc=65.4 BIC=73.43The fitted model is

yt=2.039+1.25xt+0.162xt−1+ηtyt=2.039+1.25xt+0.162xt−1+ηt ηt=1.412ηt−1−0.932ηt−2+0.359ηt−3+ϵtηt=1.412ηt−1−0.932ηt−2+0.359ηt−3+ϵt

ytyt - the number of quotations provided in month tt

xtxt - the advertising expenditure in month tt

ϵtϵt is white noise.

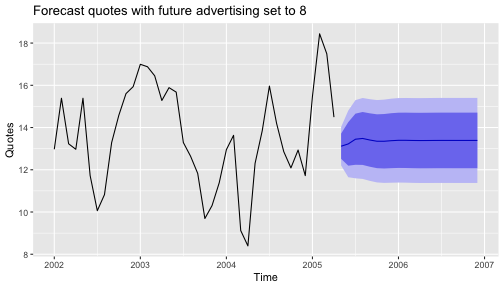

Generate forecasts

fc8 <- forecast(fit, h=20,xreg=cbind(AdLag0 = rep(8,20),AdLag1 = c(Advert[40,1], rep(8,19))))autoplot(fc8) + ylab("Quotes") +ggtitle("Forecast quotes with future advertising set to 8")

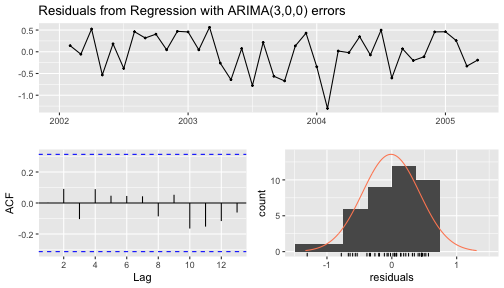

checkresiduals(fc8)

Ljung-Box testdata: Residuals from Regression with ARIMA(3,0,0) errorsQ* = 2.0324, df = 3, p-value = 0.5657Model df: 6. Total lags used: 9Other approaches

Neural network models

Machine learning approaches

TBATS models

Forecasting with decomposition

Vector autoregressions