IM532 3.0 Applied Time Series Forecasting

Exponential Smoothing Method

Dr Thiyanga Talagala

31 May 2020

Time series decomposition

Recall: Time series patterns

Trend ( Tt )

Long-term increase or decrease in the data.

Seasonal ( St )

A seasonal pattern exists when a series is influenced by seasonal factors (e.g., the quarter of the year, the month, or day of the week). Seasonality is always of a fixed and known period. Hence, seasonal time series are sometimes called periodic time series.

Period is unchanging and associated with some aspect of the calendar.

Cyclic

A cyclic pattern exists when data exhibit rises and falls that are not of fixed period. The duration of these fluctuations is usually of at least 2 years.

Time series decomposition

yt=f(St,Tt,Rt)

yt: data at period t.

Tt: trend-cycle component at period t.

St: seasonal component at period t.

Rt: remainder component at period t.

Additive decomposition

yt=St+Tt+Rt

Multiplicative decomposition

yt=St×Tt×Rt

To transform from multiplicative to additive, you can use a Box-Cox transformation (particularly, log transformation).

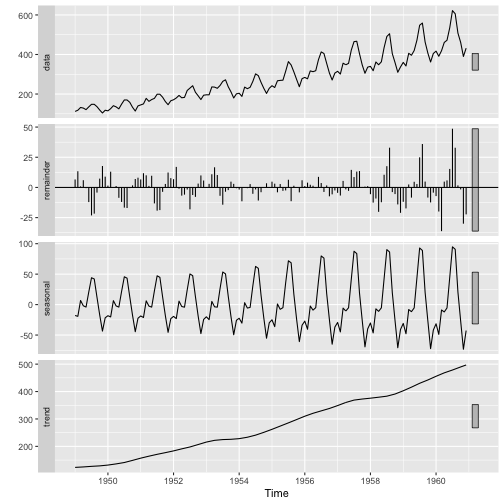

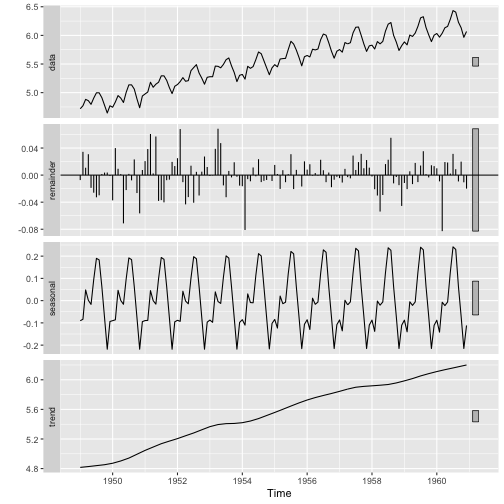

Multiplicative vs. Additive

Multiplicative

AirPassengers

Additive

log(AirPassengers)

ExponenTial Smoothing Models (ETS models)

Introduction

Naive approach

^Yt+h|t=yt

Average method

^Yt+h|t=¯y=(y1+y2+...+yt)/t

Exponential smoothing method

^Yt+1|t=αyt+(1−α)^Yt

where 0<α<1.

New forecast=[α×New observed value]+[(1−α)×Previous forecast] α - smoothing constant

Exponential Smoothing Method

^Yt+1|t=αyt+(1−α)^Yt=αyt+(1−α)[αyt−1+(1−α)^Yt−1]=αyt+α(1−α)yt−1+(1−α)2^Yt−1

Exponential Smoothing Method

^Yt+1|t=αyt+(1−α)^Yt=αyt+(1−α)[αyt−1+(1−α)^Yt−1]=αyt+α(1−α)yt−1+(1−α)2^Yt−1 Continued substitution for ^Yt−1 and so forth shows ^Yt+1 can be written as a sum of current and previous y's with exponentially declining weights.

^Yt+1|t=αyt+α(1−α)yt−1+α(1−α)2yt−2+α(1−α)3yt−3+... ^Yt+1 is an exponentially smoothed value.

Exponential Smoothing Method

^Yt+1|t=αyt+(1−α)^Yt=αyt+(1−α)[αyt−1+(1−α)^Yt−1]=αyt+α(1−α)yt−1+(1−α)2^Yt−1 Continued substitution for ^Yt−1 and so forth shows ^Yt+1 can be written as a sum of current and previous y's with exponentially declining weights.

^Yt+1|t=αyt+α(1−α)yt−1+α(1−α)2yt−2+α(1−α)3yt−3+... ^Yt+1 is an exponentially smoothed value.

The speed at which past observations lose their impact depends on the value of α.

Exponential Smoothing Method

^Yt+1|t=αyt+(1−α)^Yt=αyt+(1−α)[αyt−1+(1−α)^Yt−1]=αyt+α(1−α)yt−1+(1−α)2^Yt−1 Continued substitution for ^Yt−1 and so forth shows ^Yt+1 can be written as a sum of current and previous y's with exponentially declining weights.

^Yt+1|t=αyt+α(1−α)yt−1+α(1−α)2yt−2+α(1−α)3yt−3+... ^Yt+1 is an exponentially smoothed value.

The speed at which past observations lose their impact depends on the value of α.

The α producing the smallest forecast error is chosen for use in calculating future forecasts.

Comparison of different values for α

| Period | α=0.1 | α=0.6 |

|---|---|---|

| t | .100 | .600 |

| t−1 | .9×.1=.090 | .4×.6=.240 |

| t−2 | .9×.9×.1=.081 | .4×.4×.6=.096 |

| t−3 | .9×.9×.9×.1=.073 | .4×.4×.4×.6=.038 |

| t−4 | .9×.9×.9×.9×.1=.066 | .4×.4×.4×.4×.6=.015 |

| . | . | . |

| . | . | . |

| . | . | . |

Comparison of different values for α

| Period | α=0.1 | α=0.6 |

|---|---|---|

| t | .100 | .600 |

| t−1 | .9×.1=.090 | .4×.6=.240 |

| t−2 | .9×.9×.1=.081 | .4×.4×.6=.096 |

| t−3 | .9×.9×.9×.1=.073 | .4×.4×.4×.6=.038 |

| t−4 | .9×.9×.9×.9×.1=.066 | .4×.4×.4×.4×.6=.015 |

| . | . | . |

| . | . | . |

| . | . | . |

Factors that affects the values of forecasts

^Yt+1|t=αyt+α(1−α)yt−1+α(1−α)2yt−2+α(1−α)3yt−3+...

choice of α

initial value yt

Single Exponential Smoothing (SES)

- Suitable when data has no clear trend or seasonal pattern.

Component form

Forecasting equation

^Yt+h|t=lt

Smoothing equation

lt=αyt+(1−α)lt−1

lt - level (or smoothed value) at time t

Weighted average form

^Yt+1|t=t−1∑j=0α(1−α)jyt−j+(1−α)tl0

How to find α and l0?

minimizing SSE

SSE=T∑t=1(yt−^Yt|t−1)2=T∑t=1e2t

Example

Calculate forecasts for 2020 and 2021.

y2019=92.04 y2020=81.44

^Y2019=86.46

Find ^Y2020 and ^Y2021 when α=0.04.

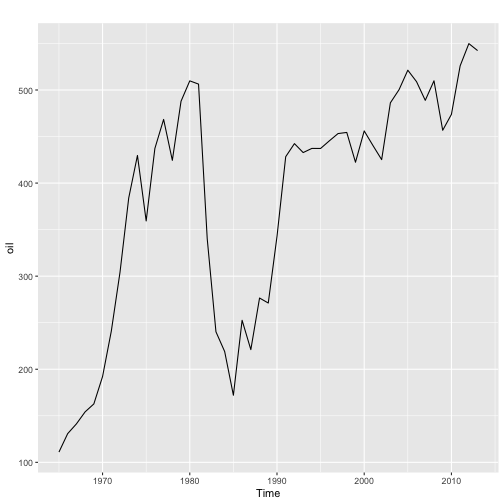

Example: oil production

# forecast, fpp2autoplot(oil)

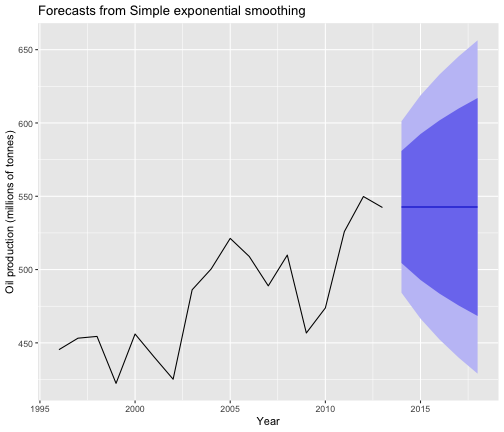

Example: oil production (cont.)

oil1996 <- window(oil, start = 1996)ses.fcast <- ses(oil1996, h=5)ses.fcast Point Forecast Lo 80 Hi 80 Lo 95 Hi 952014 542.6806 504.4541 580.9070 484.2183 601.14292015 542.6806 492.9073 592.4539 466.5589 618.80232016 542.6806 483.5747 601.7864 452.2860 633.07522017 542.6806 475.5269 609.8343 439.9778 645.38342018 542.6806 468.3452 617.0159 428.9945 656.3667Example: oil production (cont.)

summary(ses.fcast)Forecast method: Simple exponential smoothingModel Information:Simple exponential smoothing Call: ses(y = oil1996, h = 5) Smoothing parameters: alpha = 0.8339 Initial states: l = 446.5868 sigma: 29.8282 AIC AICc BIC 178.1430 179.8573 180.8141 Error measures: ME RMSE MAE MPE MAPE MASE ACF1Training set 6.401975 28.12234 22.2587 1.097574 4.610635 0.9256774 -0.03377748Forecasts: Point Forecast Lo 80 Hi 80 Lo 95 Hi 952014 542.6806 504.4541 580.9070 484.2183 601.14292015 542.6806 492.9073 592.4539 466.5589 618.80232016 542.6806 483.5747 601.7864 452.2860 633.07522017 542.6806 475.5269 609.8343 439.9778 645.38342018 542.6806 468.3452 617.0159 428.9945 656.3667Example: oil production (cont.)

ses.fcast %>% autoplot() + ylab("Oil production (millions of tonnes)") + xlab("Year")

Exponential Smoothing Models

Trend Methods

Holt's linear trend

Component form

Forecasting equation

^Yt+h|t=lt+hbt

Smoothing equation

lt=αyt+(1−α)(lt−1−bt−1) Trend

bt=β∗(lt−lt−1)+(1−β∗)bt−1

Smoothing parameters

0≤α≤1 0≤β∗≤1 Choose α, β∗, l0 and b0 minimizing SSE.

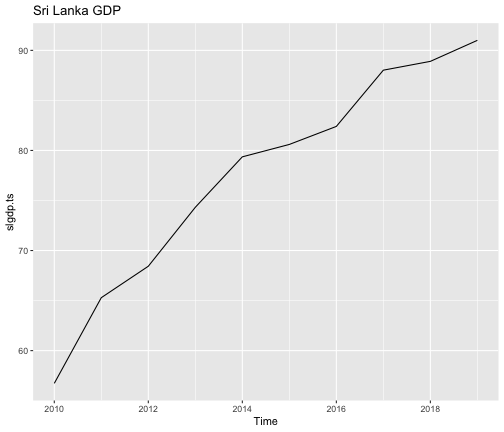

Example: Sri Lanka GDP

slgdp <- c(56.73, 65.29, 68.43, 74.32, 79.36, 80.6, 82.4, 88.02, 88.9, 91)slgdp.ts <- ts(slgdp, start=2010)autoplot(slgdp.ts)+ggtitle("Sri Lanka GDP")

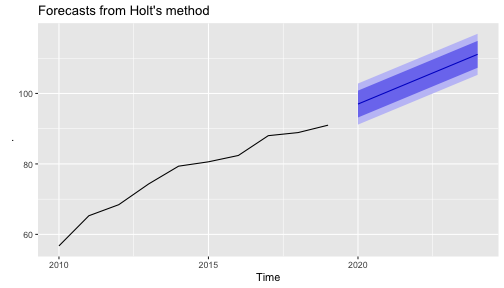

Example: Sri Lanka GDP (cont)

fcast.holt <- slgdp.ts %>% holt(h=5)fcast.holt Point Forecast Lo 80 Hi 80 Lo 95 Hi 952020 96.99317 93.18154 100.8048 91.16378 102.82262021 100.52190 96.71027 104.3335 94.69251 106.35132022 104.05064 100.23900 107.8623 98.22124 109.88002023 107.57937 103.76773 111.3910 101.74997 113.40882024 111.10810 107.29646 114.9197 105.27871 116.9375fcast.holt %>% autoplot()

Example: Sri Lanka GDP (cont)

summary(fcast.holt)Forecast method: Holt's methodModel Information:Holt's method Call: holt(y = ., h = 5) Smoothing parameters: alpha = 1e-04 beta = 1e-04 Initial states: l = 58.1775 b = 3.5288 sigma: 2.9742 AIC AICc BIC 49.71733 64.71733 51.23025 Error measures: ME RMSE MAE MPE MAPE MASETraining set -0.07963403 2.303832 1.777759 -0.3047917 2.437425 0.4668757 ACF1Training set 0.2014695Forecasts: Point Forecast Lo 80 Hi 80 Lo 95 Hi 952020 96.99317 93.18154 100.8048 91.16378 102.82262021 100.52190 96.71027 104.3335 94.69251 106.35132022 104.05064 100.23900 107.8623 98.22124 109.88002023 107.57937 103.76773 111.3910 101.74997 113.40882024 111.10810 107.29646 114.9197 105.27871 116.9375Damped trend method

Component form

Forecasting equation

^Yt+h|t=lt+(ϕ+ϕ2+...+ϕh)

Smoothing equation

lt=αyt+(1−α)(lt−1−ϕbt−1) Trend

bt=β∗(lt−lt−1)+(1−β∗)ϕbt−1

Damping parameter: 0<ϕ<1.

If ϕ=1, identical to Holt's linear trend.

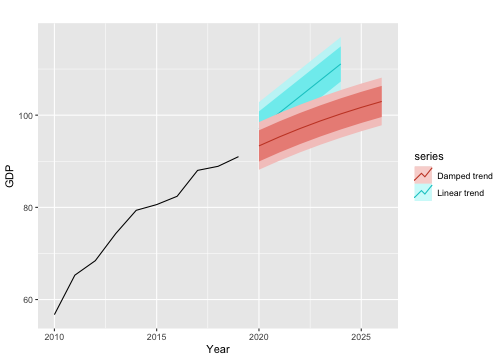

Example

fcast_holt <- slgdp.ts %>% holt(h=7)fcast_holt_damped <- slgdp.ts %>% holt(h=7, damped = TRUE)autoplot(slgdp.ts) + xlab("Year") + ylab("GDP")+ autolayer(fcast.holt, series="Linear trend")+ autolayer(fcast_holt_damped, series="Damped trend")

Exponential Smoothing Models

Trend + Seasonal

Holt-Winters' additive method

Component form

Forecasting equation

^Yt+h|t=lt+hbt+st−m+h+m

Smoothing equation

lt=α(yt−st−m)+(1−α)(lt−1+bt−1) bt=β∗(lt−lt−1)+(1−β∗)bt−1 st=γ(yt−lt−1−bt−1)+(1−γ)st−m

st−1+h+m - seasonal component from last year of data

Smoothing parameters:

0≤α≤1, 0≤β∗≤1 and 0≤γ≤1−α

- m: seasonal period

Holt-Winters' multiplicative method

Component form

Forecasting equation

^Yt+h|t=(lt+hbt)st−m+h+m

Smoothing equation

lt=αytst−m+(1−α)(lt−1+bt−1) bt=β∗(lt−lt−1)+(1−β∗)bt−1 st=γyt(lt−1+bt−1)+(1−γ)st−m

st−1+h+m - seasonal component from last year of data

Smoothing parameters:

0≤α≤1, 0≤β∗≤1 and 0≤γ≤1−α

- m: seasonal period

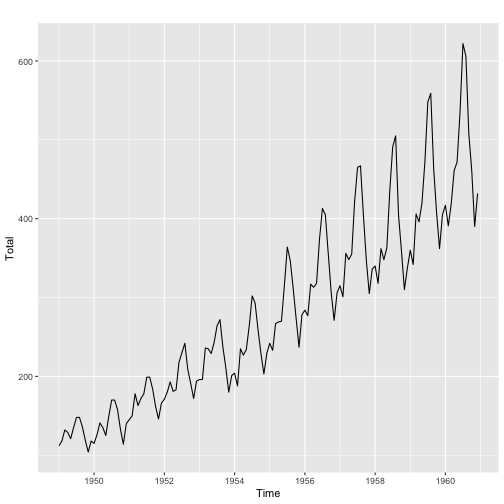

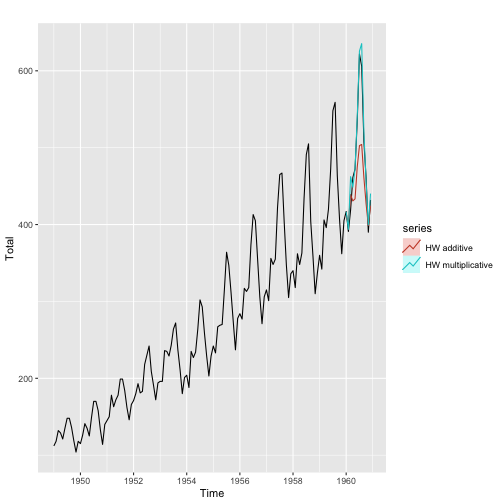

Example

AirPassengers.trn <- window(AirPassengers, end=c(1959, 12))fcast.additive <- hw(AirPassengers.trn, seasonal="additive", h=12)fcast.multiplicative <- hw(AirPassengers.trn, seasonal="multiplicative", h=12)fcast.additive Point Forecast Lo 80 Hi 80 Lo 95 Hi 95Jan 1960 409.2577 388.1899 430.3256 377.0373 441.4782Feb 1960 402.8045 373.0119 432.5970 357.2407 448.3683Mar 1960 439.0902 402.5995 475.5810 383.2824 494.8980Apr 1960 430.7499 388.6097 472.8900 366.3021 495.1977May 1960 433.3781 386.2587 480.4976 361.3151 505.4411Jun 1960 474.8847 423.2618 526.5077 395.9342 553.8353Jul 1960 502.6950 446.9289 558.4611 417.4082 587.9819Aug 1960 504.2110 444.5870 563.8349 413.0240 595.3980Sep 1960 461.0817 397.8328 524.3305 364.3509 557.8124Oct 1960 426.6746 359.9959 493.3533 324.6983 528.6509Nov 1960 398.6437 328.7014 468.5860 291.6762 505.6112Dec 1960 424.4781 351.4162 497.5399 312.7396 536.2165Example (cont.)

fcast.multiplicative Point Forecast Lo 80 Hi 80 Lo 95 Hi 95Jan 1960 416.6188 394.3272 438.9105 382.5267 450.7110Feb 1960 393.6628 371.3633 415.9624 359.5587 427.7670Mar 1960 462.3467 434.7187 489.9747 420.0934 504.6001Apr 1960 448.5228 420.3370 476.7085 405.4164 491.6291May 1960 472.2089 441.0871 503.3307 424.6123 519.8055Jun 1960 540.0026 502.7660 577.2392 483.0542 596.9510Jul 1960 625.6443 580.6024 670.6862 556.7586 694.5300Aug 1960 635.3948 587.7281 683.0615 562.4948 708.2947Sep 1960 520.6261 479.9980 561.2542 458.4908 582.7614Oct 1960 455.1924 418.2998 492.0850 398.7701 511.6147Nov 1960 399.6811 366.0861 433.2762 348.3020 451.0603Dec 1960 440.2986 401.9675 478.6297 381.6763 498.9209Example (cont.)

summary(fcast.additive)Forecast method: Holt-Winters' additive methodModel Information:Holt-Winters' additive method Call: hw(y = AirPassengers.trn, h = 12, seasonal = "additive") Smoothing parameters: alpha = 0.9996 beta = 3e-04 gamma = 3e-04 Initial states: l = 121.2277 b = 1.597 s = -26.7836 -50.9792 -21.3319 14.7009 59.4508 59.53 33.3833 -6.519 -7.5225 2.4467 -32.2225 -24.153 sigma: 16.4393 AIC AICc BIC 1400.588 1405.957 1449.596 Error measures: ME RMSE MAE MPE MAPE MASE ACF1Training set 0.7468154 15.41083 11.57204 0.2589801 5.002286 0.3800341 0.1636311Forecasts: Point Forecast Lo 80 Hi 80 Lo 95 Hi 95Jan 1960 409.2577 388.1899 430.3256 377.0373 441.4782Feb 1960 402.8045 373.0119 432.5970 357.2407 448.3683Mar 1960 439.0902 402.5995 475.5810 383.2824 494.8980Apr 1960 430.7499 388.6097 472.8900 366.3021 495.1977May 1960 433.3781 386.2587 480.4976 361.3151 505.4411Jun 1960 474.8847 423.2618 526.5077 395.9342 553.8353Jul 1960 502.6950 446.9289 558.4611 417.4082 587.9819Aug 1960 504.2110 444.5870 563.8349 413.0240 595.3980Sep 1960 461.0817 397.8328 524.3305 364.3509 557.8124Oct 1960 426.6746 359.9959 493.3533 324.6983 528.6509Nov 1960 398.6437 328.7014 468.5860 291.6762 505.6112Dec 1960 424.4781 351.4162 497.5399 312.7396 536.2165summary(fcast.multiplicative)Forecast method: Holt-Winters' multiplicative methodModel Information:Holt-Winters' multiplicative method Call: hw(y = AirPassengers.trn, h = 12, seasonal = "multiplicative") Smoothing parameters: alpha = 0.3392 beta = 0.0105 gamma = 0.6534 Initial states: l = 122.569 b = 1.51 s = 0.9296 0.7992 0.9096 1.0615 1.1326 1.177 1.0374 0.9334 1.0075 1.0984 0.9852 0.9288 sigma: 0.0418 AIC AICc BIC 1270.460 1275.829 1319.468 Error measures: ME RMSE MAE MPE MAPE MASE ACF1Training set 1.369382 9.949946 7.533284 0.2993092 2.99775 0.2473985 0.3047973Forecasts: Point Forecast Lo 80 Hi 80 Lo 95 Hi 95Jan 1960 416.6188 394.3272 438.9105 382.5267 450.7110Feb 1960 393.6628 371.3633 415.9624 359.5587 427.7670Mar 1960 462.3467 434.7187 489.9747 420.0934 504.6001Apr 1960 448.5228 420.3370 476.7085 405.4164 491.6291May 1960 472.2089 441.0871 503.3307 424.6123 519.8055Jun 1960 540.0026 502.7660 577.2392 483.0542 596.9510Jul 1960 625.6443 580.6024 670.6862 556.7586 694.5300Aug 1960 635.3948 587.7281 683.0615 562.4948 708.2947Sep 1960 520.6261 479.9980 561.2542 458.4908 582.7614Oct 1960 455.1924 418.2998 492.0850 398.7701 511.6147Nov 1960 399.6811 366.0861 433.2762 348.3020 451.0603Dec 1960 440.2986 401.9675 478.6297 381.6763 498.9209Example (cont.)

summary(fcast.multiplicative)Forecast method: Holt-Winters' multiplicative methodModel Information:Holt-Winters' multiplicative method Call: hw(y = AirPassengers.trn, h = 12, seasonal = "multiplicative") Smoothing parameters: alpha = 0.3392 beta = 0.0105 gamma = 0.6534 Initial states: l = 122.569 b = 1.51 s = 0.9296 0.7992 0.9096 1.0615 1.1326 1.177 1.0374 0.9334 1.0075 1.0984 0.9852 0.9288 sigma: 0.0418 AIC AICc BIC 1270.460 1275.829 1319.468 Error measures: ME RMSE MAE MPE MAPE MASE ACF1Training set 1.369382 9.949946 7.533284 0.2993092 2.99775 0.2473985 0.3047973Forecasts: Point Forecast Lo 80 Hi 80 Lo 95 Hi 95Jan 1960 416.6188 394.3272 438.9105 382.5267 450.7110Feb 1960 393.6628 371.3633 415.9624 359.5587 427.7670Mar 1960 462.3467 434.7187 489.9747 420.0934 504.6001Apr 1960 448.5228 420.3370 476.7085 405.4164 491.6291May 1960 472.2089 441.0871 503.3307 424.6123 519.8055Jun 1960 540.0026 502.7660 577.2392 483.0542 596.9510Jul 1960 625.6443 580.6024 670.6862 556.7586 694.5300Aug 1960 635.3948 587.7281 683.0615 562.4948 708.2947Sep 1960 520.6261 479.9980 561.2542 458.4908 582.7614Oct 1960 455.1924 418.2998 492.0850 398.7701 511.6147Nov 1960 399.6811 366.0861 433.2762 348.3020 451.0603Dec 1960 440.2986 401.9675 478.6297 381.6763 498.9209Example (cont.)

AirPassengers.test <- window(AirPassengers, start=1960)accuracy(fcast.additive, AirPassengers.test) ME RMSE MAE MPE MAPE MASETraining set 0.7468154 15.41083 11.57204 0.2589801 5.002286 0.3800341Test set 33.8375637 53.79669 40.59396 6.0173405 7.689038 1.3331351 ACF1 Theil's UTraining set 0.1636311 NATest set 0.6670272 0.943033accuracy(fcast.multiplicative, AirPassengers.test) ME RMSE MAE MPE MAPE MASETraining set 1.369382 9.949946 7.533284 0.2993092 2.997750 0.2473985Test set -8.016665 16.583116 11.127665 -1.6894318 2.365723 0.3654406 ACF1 Theil's UTraining set 0.3047973 NATest set -0.2976567 0.3561253Example (cont.)

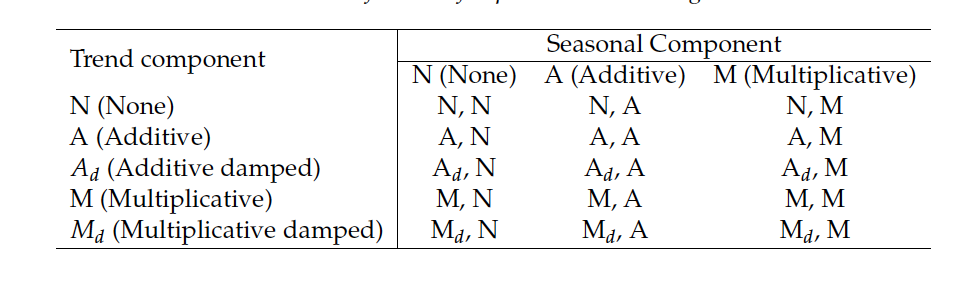

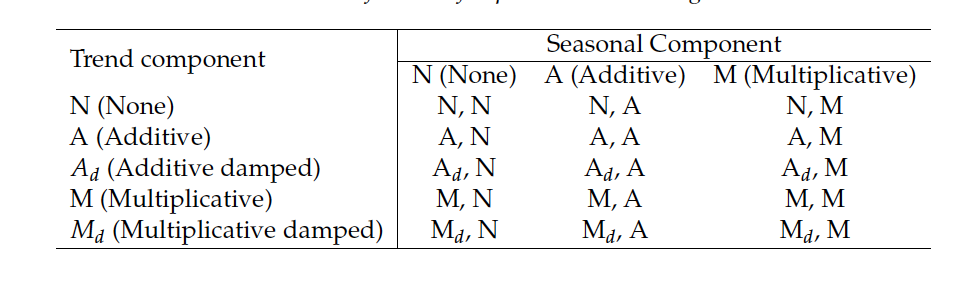

Taxonomy of ETS methods

Taxonomy of ETS methods

Trend

(N,N): Simple exponential smoothing - ses()

(A,N): Holt's linear method - holt()

(Ad,N): Additive damped trend method - hw()

Trend+Seasonal

(A,A): Additive Holt-Winter's method - hw()

(A,M): Multiplicative Holt-Winter's method - hw()

(Ad,M): Damped Multiplicative Holt-Winter's method - hw()

Innovations state space models

[Error, Trend, Seasonal]

Error: Additive−A,Multiplicative−M

Trend: Notrend−N,Trend−A,Dampedtrend−Ad

Seasonal: Noseasonal−N,Additive−A,MultiplicativeM

Example:

ETS(A,A,A)

Automated ETS algorithm

30 models → 19 numerically stable → 15 models (multiplicative trend gives poor forecast)

30 models → 19 numerically stable → 15 models (multiplicative trend gives poor forecast)

The steps involved are summarised below [Hyndman et al., 2008]:

For each series, apply each of the 15 models that are appropriate for the data.

For each model, optimise the parameters (smoothing parameters and initial values for the states) using maximum likelihood estimation.

- For models with additive errors, this is equivalent to minimizing SSE.

Select the best model using the corrected Akaike's Information Criterion (AICc) and produce forecasts using the best selected model.

Automated ETS algorithm in R

Automated ETS algorithm in R

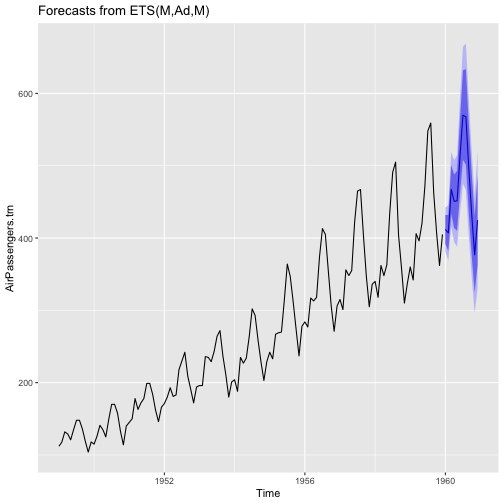

ets.auto <- ets(AirPassengers.trn)ets.autoETS(M,Ad,M) Call: ets(y = AirPassengers.trn) Smoothing parameters: alpha = 0.758 beta = 0.0213 gamma = 1e-04 phi = 0.98 Initial states: l = 120.7483 b = 1.7632 s = 0.897 0.798 0.919 1.0587 1.2156 1.2251 1.1075 0.9782 0.9804 1.0207 0.8926 0.9073 sigma: 0.0378 AIC AICc BIC 1244.458 1250.511 1296.348Automated ETS algorithm in R (cont.)

auto.ets.fcast <- forecast(ets.auto, h=12)auto.ets.fcast Point Forecast Lo 80 Hi 80 Lo 95 Hi 95Jan 1960 411.9115 391.9778 431.8452 381.4255 442.3974Feb 1960 406.9694 382.0344 431.9043 368.8346 445.1041Mar 1960 467.3486 433.5448 501.1524 415.6501 519.0470Apr 1960 450.7386 413.6375 487.8397 393.9974 507.4798May 1960 451.5327 410.1879 492.8776 388.3012 514.7642Jun 1960 513.2314 461.7576 564.7052 434.5091 591.9538Jul 1960 569.8868 507.9846 631.7890 475.2156 664.5580Aug 1960 567.5873 501.3865 633.7882 466.3419 668.8328Sep 1960 496.1471 434.4291 557.8652 401.7575 590.5368Oct 1960 432.2153 375.1873 489.2432 344.9985 519.4320Nov 1960 376.6263 324.1565 429.0961 296.3807 456.8719Dec 1960 424.7869 362.5403 487.0334 329.5889 519.9848Automated ETS algorithm in R (cont.)

auto.ets.fcast %>% autoplot()

Automated ETS algorithm in R (cont.)

accuracy(auto.ets.fcast, AirPassengers.test)## ME RMSE MAE MPE MAPE MASE## Training set 1.511141 9.353686 6.980909 0.4422335 2.761156 0.2292581## Test set 12.084843 27.398040 22.804502 2.0517668 4.655647 0.7489163## ACF1 Theil's U## Training set 0.0457192 NA## Test set 0.4844065 0.5419859Comparison

accuracy(auto.ets.fcast, AirPassengers.test) ME RMSE MAE MPE MAPE MASETraining set 1.511141 9.353686 6.980909 0.4422335 2.761156 0.2292581Test set 12.084843 27.398040 22.804502 2.0517668 4.655647 0.7489163 ACF1 Theil's UTraining set 0.0457192 NATest set 0.4844065 0.5419859Previous results: Holt-Winters' additive method and Holt-Winters' multiplicative method

accuracy(fcast.additive, AirPassengers.test) ME RMSE MAE MPE MAPE MASETraining set 0.7468154 15.41083 11.57204 0.2589801 5.002286 0.3800341Test set 33.8375637 53.79669 40.59396 6.0173405 7.689038 1.3331351 ACF1 Theil's UTraining set 0.1636311 NATest set 0.6670272 0.943033accuracy(fcast.multiplicative, AirPassengers.test) ME RMSE MAE MPE MAPE MASETraining set 1.369382 9.949946 7.533284 0.2993092 2.997750 0.2473985Test set -8.016665 16.583116 11.127665 -1.6894318 2.365723 0.3654406 ACF1 Theil's UTraining set 0.3047973 NATest set -0.2976567 0.3561253Check Residuals

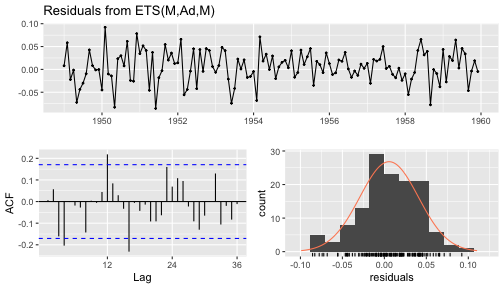

checkresiduals(ets.auto)

Ljung-Box testdata: Residuals from ETS(M,Ad,M)Q* = 38.252, df = 7, p-value = 2.714e-06Model df: 17. Total lags used: 24Check Residuals (cont.)

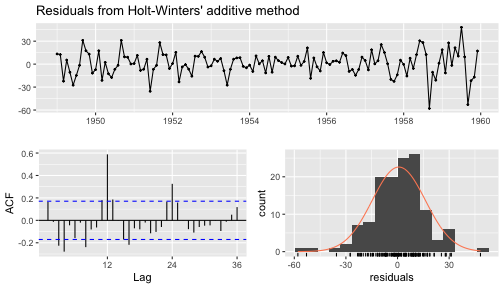

checkresiduals(fcast.additive)

Ljung-Box testdata: Residuals from Holt-Winters' additive methodQ* = 135.55, df = 8, p-value < 2.2e-16Model df: 16. Total lags used: 24Check Residuals (cont.)

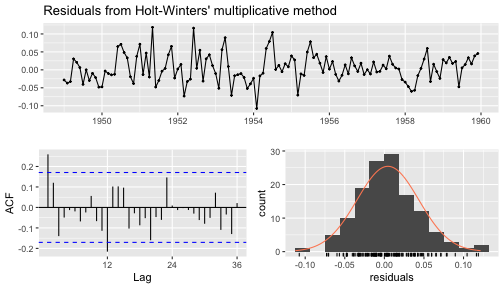

checkresiduals(fcast.multiplicative)

Ljung-Box testdata: Residuals from Holt-Winters' multiplicative methodQ* = 41.164, df = 8, p-value = 1.943e-06Model df: 16. Total lags used: 24Your turn

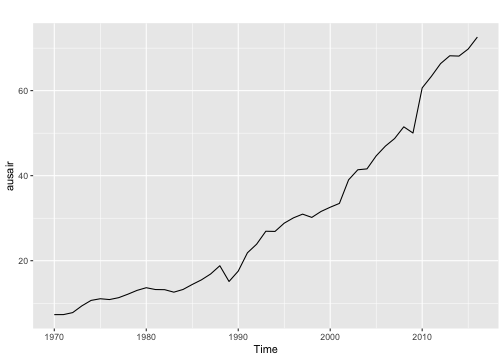

Identify a suitable ETS to forecast Australian air traffic data.

autoplot(ausair)

ausairTime Series:Start = 1970 End = 2016 Frequency = 1 [1] 7.31870 7.32660 7.79560 9.38460 10.66470 11.05510 10.86430 11.30650 [9] 12.12230 13.02250 13.64880 13.21950 13.18790 12.60150 13.23680 14.41210[17] 15.49730 16.88020 18.81630 15.11430 17.55340 21.86010 23.88660 26.92930[25] 26.88850 28.83140 30.07510 30.95350 30.18570 31.57970 32.57757 33.47740[33] 39.02158 41.38643 41.59655 44.65732 46.95177 48.72884 51.48843 50.02697[41] 60.64091 63.36031 66.35527 68.19795 68.12324 69.77935 72.59770ausair.tr <- window(ausair, end=2011)ausair.trTime Series:Start = 1970 End = 2011 Frequency = 1 [1] 7.31870 7.32660 7.79560 9.38460 10.66470 11.05510 10.86430 11.30650 [9] 12.12230 13.02250 13.64880 13.21950 13.18790 12.60150 13.23680 14.41210[17] 15.49730 16.88020 18.81630 15.11430 17.55340 21.86010 23.88660 26.92930[25] 26.88850 28.83140 30.07510 30.95350 30.18570 31.57970 32.57757 33.47740[33] 39.02158 41.38643 41.59655 44.65732 46.95177 48.72884 51.48843 50.02697[41] 60.64091 63.36031ausair.test <- window(ausair, start=2012)ausair.testTime Series:Start = 2012 End = 2016 Frequency = 1 [1] 66.35527 68.19795 68.12324 69.77935 72.59770